Legacy Suite Introduces Legal and Digital Suite to Product Portfolio

Digital asset management platform offers password sharing, a ‘crypto will’ and protection of clients’ digital lives

Digital asset management platform offers password sharing, a ‘crypto will’ and protection of clients’ digital lives

NEW YORK – November 1, 2022 – (Newswire.com)

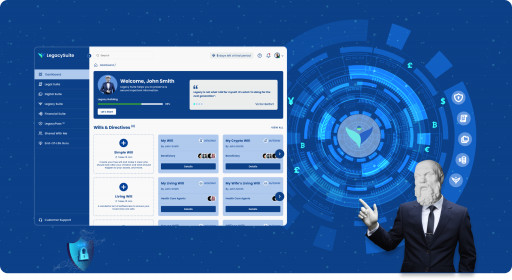

With a reported $140 billion in cryptocurrency stranded in inaccessible storage, the need for better digital asset management is more apparent than ever. Legacy Suite, the industry leader in digital asset preservation, has announced the rollout of Legal and Digital Suite, solutions designed to protect assets like cryptocurrencies, NFTs, and legal directives, and to ensure they are shared properly and securely in the event of a death or emergency.

“Most internet users’ lives have become even more digitally focused in just the past few years,” said Gordon Bell, founder, and president of Legacy Suite. “With the advent of cryptocurrencies and NFTs, people are using crypto wallets and blockchain technology to store and manage their digital assets. They are also creating more legal directives to ensure all types of assets are protected. We created Digital Suite and Legal Suite to give them peace of mind.”

Citing research by blockchain analysis firm Chainalysis, The New York Times reported that about 20% of all 18.5 million Bitcoin, valued at $140 billion, were lost or stranded in crypto wallets. Thousands of people have lost access to their cryptocurrencies, NFTs, and other assets because of digital management problems, an issue that has plagued crypto investing from the outset.

Legacy Suite’s Legal and Digital Suite enables clients to properly plan for the transferring of such assets or the sharing of private keys to protect them through blockchain technology. Through its patent-pending platform, Legacy Suite modernizes the traditional estate planning process with its critical ledger of crypto, NFTs, and all other forms of digital assets in a single secure, personalized, and centralized location.

The Legacy Suite platform makes it simple for users to safeguard important details regarding real estate and financial assets, social media accounts, email accounts, phone and computer passcodes, domain names, utilities, subscriptions, and seller accounts. Legacy Suite is designed for use with a partner or spouse, to protect the family’s assets.

Legacy Suite’s Digital Suite product lets clients manage, create, and share data, digital vaults, and passwords. Users can leverage the suite to store files and individually assign them to digital executors and trusted contacts.

The Legal Suite product can construct digital directives for cryptocurrencies, NFTs, social purposes, healthcare purposes, as well as power of attorney documents. A vault is also included through the Legal Suite line that can be used to safely organize and manage that documentation.

Maintaining those assets in one centralized location makes password sharing and the strategic distribution of critical information simple and efficient. Legacy Suite allows heirs to have full knowledge of an entire digital portfolio, such as what was owned by the original user, where certain assets are located, and how they can access them if the original user dies or becomes incapacitated.

Legacy Suite products leverage blockchain technology to protect those assets. It employs security encryptions cast using 256-bit AES encryption out of 128-bit and 192-bit to create a virtually impenetrable level of security. That secure storage, combined with the ability to reliably control shared access, ensures that assets are never lost or stranded.

The products leverage password manager LegacyPass™️, which has unique capabilities and uses innovative blockchain technology to encrypt and decrypt information using the Hybrid encryption scheme to share passwords and credentials securely with loved ones.

In addition, the Legacy Suite team continues to think and create and plans to add additional features in future generations of the platform, while providing an invaluable service at value pricing.

To learn more about Legacy Suite’s rollout of the new Legal and Digital Suite, please visit https://www.legacysuite.com.

About Legacy Suite

We’re thinkers, no. Artists, yes. We are determined to reframe digital utility, to shape and sculpt your legacy. Day in and day out, our artists like to challenge their mantra and are a group of code casters that don’t know when to quit. Visit https://www.legacysuite.com.

Contact Information:

Buse Kayar

Press Release Service

by

Newswire.com

Original Source:

Legacy Suite Introduces Legal and Digital Suite to Product Portfolio