Stouffer Legal Expands Presence in Maryland With New Office in Annapolis

Stouffer Legal Brings Expert Estate Planning Services to Annapolis Community

Stouffer Legal Brings Expert Estate Planning Services to Annapolis Community

Attorneys of Stouffer Legal Legal Team together from Stouffer Legal …

Stouffer Legal Brings Expert Estate Planning Services to Annapolis Community

Stouffer Legal Brings Expert Estate Planning Services to Annapolis Community

Attorneys of Stouffer Legal Legal Team together from Stouffer Legal …

NEW YORK, February 3, 2023 (Newswire.com)

–

iQuanti: Like it or not, the financial world judges you based on your credit score. Your FICO credit score is a number (ranging between 300 and 850) that represents your creditworthiness, or how likely you’ll be able to repay the lender. Read on to learn what a FICO score is, what factors can influence it, and how you can improve yours.

How your FICO score works

A FICO score is the credit rating determined by the Fair Isaac Corporation, a data analytics company that originally developed credit scores. FICO uses credit history reported to the major credit bureaus (Experian, Equifax, and TransUnion) to determine how reliable of a borrower you’ll be.

You may be wondering if there’s a difference between a FICO score vs. credit score. Your FICO score is a specific type of credit score. It’s the most widely recognized and used by many lenders in their application decisions.

However, FICO is not the only type of credit score. Competitors such as VantageScore can also be used to determine your creditworthiness. When checking your credit score, it’s important to know whether the number being reported is your FICO score, VantageScore, or some other variation.

What factors affect my FICO score?

FICO’s website makes it clear what data from your credit history is used when calculating your credit rating. This can be summarized into five major categories:

How to improve your FICO score

Raising your credit score is rooted in practicing good, responsible financial habits. Here are a few tips you could use to increase yours.

The bottom line

FICO scores are the most recognized and widely used type of credit score. They’re calculated by taking input from your credit history and using it to determine your creditworthiness. You can improve your credit score by practicing good financial habits, such as paying your bills on time and using your credit lines moderately.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Original Source:

A Beginner’s Guide to Your FICO Score

NEW YORK, February 3, 2023 (Newswire.com)

–

iQuanti: Moving is a big deal, and with a thousand moving parts, it’s easy for the stress to begin pouring in. Whi…

NOTA Logo Nota logo

LOS ANGELES, February 3, 2023 (Newswire.com)

–

Nota announced today that it has entered into a partnership agreement with The…

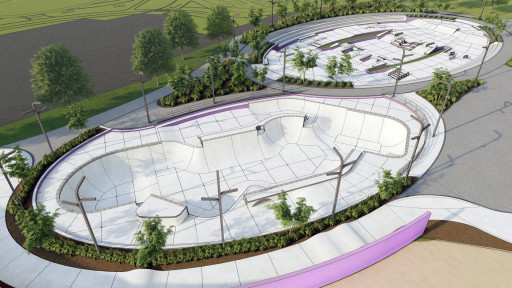

California Skateparks-designed Aljada Skatepark hosts world’s best on their road to Paris.

California Skateparks-designed Aljada Skatepark hosts world’s best on their road to Paris.

VISTA, Calif., February 3, 2023 (Newswire.com)

–

The world’s best skateboarders are performing their newest tricks this week at the massive Aljada Skatepark in Sharjah, UAE. Designed and built by California Skateparks, Aljada is hosting the World Skate 2022 World Championships for both Street and Park disciplines. After the new Champions are named next week, Aljada will remain as a permanent skatepark serving local youth.

“The facility is unique and has beginner, intermediate, and elite competition-level Street and Park courses and covers almost 90,000 square feet (8,360 square meters),” said California Skateparks VP Bill Minadeo. “This is an amazing opportunity for local youth to interact with the world’s best skaters and host incredible events, like the World Championships.”

The World Skate 2022 World Championships is a key qualifying event for the Paris 2024 Olympics. While the Street skaters have already competed in one qualifier in Rome last Summer, Sharjah will be the first chance for the Park skaters to earn important points to qualify for Paris.

This weekend the Street skaters have their chance to earn the World title, with the Finals in the Men’s and Women’s competition taking place. The Street course at Aljada features a mirrored core section, with identical elements such as stairs and rails providing equal opportunity for both goofy- and regular-stance skaters to perform. The outer perimeter of the course includes more free-form features, allowing skaters to explore opportunities for unique tricks and combinations.

Next week, the Park competitors have their turn and attention will shift to the massive bowl, which differs from recent competition bowl designs. The traditional single deep end is replaced by two nearly 10-foot (3-meter) deep ends on opposite sides of the bowl. To take full advantage of that, a long, sloping channel flows into the bowl from the deck, allowing skaters to begin their routines with maximum speed. The volcano flyover feature included in the Olympic Park course has been replaced by a hip/transfer section extending into the bowl from the side, instead of being the bowl’s centerpiece.

Both the street course and competition bowl are the result of the California Skateparks design team’s nearly two-decades experience creating elite competition courses. In consultation with many athletes competing in Sharjah, the designers modified traditional contest elements and complemented them with new features that match the skaters’ growing level of competitiveness and evolving style of tricks. From early practice footage seen from Sharjah, evidence suggests that the California Skateparks design team got it right, including social-media posts showing how much fun visiting pros are having at Aljada. Which is great news for Sharjah’s local skaters.

For more information about the World Skate 2022 World Championships, visit www.worldskate.org/skateboarding.

To learn more about California Skateparks, visit www.californiaskateparks.com or contact Bill Minadeo: [email protected]

Contact Information:

Bill Minadeo

Vice President

Original Source:

Top Skateboarders Converge on Sharjah UAE for World Championships

Japanese Fashion designer YUIMA NAKAZATO presented his Spring Summer 2022 Haute Couture Collection, that explores the unclear area where fantasy and reality meet, on January 27th, during the last day of the recently finished Paris Fashion Week. The Liminal collection was inspired by mythical creature Chimera (a monstrous fire-breathing hybrid creature, composed of different animal […]

Japanese Fashion designer YUIMA NAKAZATO presented his Spring Summer 2022 Haute Couture Collection, that explores the unclear area where fantasy and reality meet, on January 27th, during the last day of the recently finished Paris Fashion Week. The Liminal collection was inspired by mythical creature Chimera (a monstrous fire-breathing hybrid creature, composed of different animal […]

Christian Dior. Spring-Summer 2023 Couture Collection during Haute Couture Week.The craft of thoughtFor Maria Grazia…

In ET’s exclusive sneak peek of ‘The Family Chantel,’ Pedro speaks with Chantel’s mother, Karen, about their ongoing divorce. Pedro doesn’t mince words as he criticizes the family and calls them ‘fake.’ Season 4 of ‘The F…

NEW YORK, February 2, 2023 (Newswire.com)

–

iQuanti: Cashier’s checks and money orders are certified funds — payment guaranteed to clear when you use it. You can pay for the cashier’s check or money order ahead of time and get a piece of paper representing the payment. You then pay with the cashier’s check or money order. Then, the company that sold you the cashier’s check or money order transfers the money. Doing this prevents bounced checks and insufficient funds since you already paid.

All that said, cashier’s checks and money orders differ in several ways. These differences make each one suitable for distinct situations. This article will compare a cashier’s check vs. money order by defining each and looking at their benefits and drawbacks.

How do cashier’s checks work?

Cashier’s checks are a type of official check issued by banks and credit unions. When you buy a cashier’s check, the institution draws funds from your savings or checking account to cover the amount plus the issuing fee and then signs and issues you a check. You can then use the cashier’s check for your purchase.

Pro: Available in large amounts

Policies differ between banks, but cashier’s checks generally don’t have a limit on the amount you can get one for. As a result, cashier’s checks can often be used for larger purchases.

Pro: More secure

In general, cashier’s checks are considered to be more secure than money orders. They are offered only by banks and are used for large purchases, so they come with additional security features to guard against fraud.

Con: Only available at banks and credit unions

You can get cashier’s checks at banks and credit unions, but you also must have an account with that bank or credit union to do so. You can visit a bank branch to get a cashier’s check or go on their online website to order one.

Con: More expensive

Many banks sell cashier’s checks for no lower than $10. Some may sell them for even more. This is a substantial fee simply for accessing your money, so make sure you must use a cashier’s check for the specific expense.

How do money orders work?

Money orders are another form of certified payment available at banks and credit unions, but also supermarkets, convenience stores, and several other locations. You can purchase a money order by paying the amount you want plus an issuing fee with cash, debit card, or traveler’s check. You generally can’t use credit cards since those are forms of debt. If you do, it may be treated as a cash advance. Upon purchase, the issuer hands you a check representing that money order. When you pay someone with the money order, the issuer transfers funds to the payee.

Pro: Widespread availability

Money orders are sold at many locations that you might visit regularly. Some places you can purchase a money order include:

Pro: Cheaper

Money orders tend to cost no more than $2 to $3. This makes them more affordable than cashier’s checks. Plus, since they’re available at more locations, you have more room to compare costs and find the cheapest money order provider.

Con: Lower limits

Money orders are generally available for up to $1,000. Many money order providers won’t let you purchase a money order larger than this. For larger purchases, you’ll have to buy multiple money orders and pay the fee each time.

Con: Must be bought in person

Money order issuers must verify your identity, which can be hard to do over the Internet. So, keep in mind that money orders are rarely, if ever, available online. On the other hand, cashier’s checks are only available at banks and credit unions, but you can often buy them online since you’ll have a bank account with the bank already.

The bottom line

Both cashier’s checks and money orders are certified funds. Each one’s specific features suit them for different situations. Cashier’s checks generally offer large amounts and higher security but cost more and are only available at banks and credit unions. So, cashier’s checks can be excellent tools for putting a down payment on a home or car.

Meanwhile, money orders are cheaper and available at numerous locations. However, they’re only available for up to $1,000 in most cases. As a result, money orders can be helpful for paying bills or placing a deposit on an apartment. Make sure to weigh these features against your specific expense to decide whether a cashier’s check or money order fits your needs best.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Original Source:

Cashier’s Check vs. Money Order: Pros and Cons