CBD Body Blends Adds Cool Freeze Blend to Five of Its Most Popular 0.00% THC Products

Colorado Company Handcrafts +300 Exceptional Everyday Products With 100% THC-Free Hemp-Based CBD for People & Pets

Colorado Company Handcrafts +300 Exceptional Everyday Products With 100% THC-Free Hemp-Based CBD for People & Pets

CBD Body Blends Cool Freeze Prod…

Colorado Company Handcrafts +300 Exceptional Everyday Products With 100% THC-Free Hemp-Based CBD for People & Pets

Colorado Company Handcrafts +300 Exceptional Everyday Products With 100% THC-Free Hemp-Based CBD for People & Pets

CBD Body Blends Cool Freeze Prod…

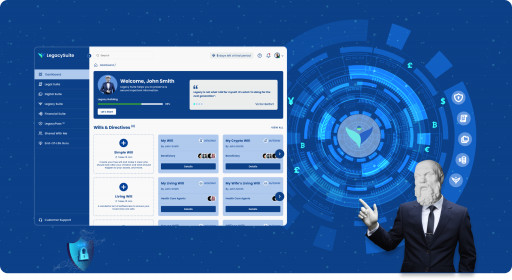

Digital asset management platform offers password sharing, a ‘crypto will’ and protection of clients’ digital lives

Digital asset management platform offers password sharing, a ‘crypto will’ and protection of clients’ digital lives

NEW YORK – November 1, 2022 – (Newswire.com)

With a reported $140 billion in cryptocurrency stranded in inaccessible storage, the need for better digital asset management is more apparent than ever. Legacy Suite, the industry leader in digital asset preservation, has announced the rollout of Legal and Digital Suite, solutions designed to protect assets like cryptocurrencies, NFTs, and legal directives, and to ensure they are shared properly and securely in the event of a death or emergency.

“Most internet users’ lives have become even more digitally focused in just the past few years,” said Gordon Bell, founder, and president of Legacy Suite. “With the advent of cryptocurrencies and NFTs, people are using crypto wallets and blockchain technology to store and manage their digital assets. They are also creating more legal directives to ensure all types of assets are protected. We created Digital Suite and Legal Suite to give them peace of mind.”

Citing research by blockchain analysis firm Chainalysis, The New York Times reported that about 20% of all 18.5 million Bitcoin, valued at $140 billion, were lost or stranded in crypto wallets. Thousands of people have lost access to their cryptocurrencies, NFTs, and other assets because of digital management problems, an issue that has plagued crypto investing from the outset.

Legacy Suite’s Legal and Digital Suite enables clients to properly plan for the transferring of such assets or the sharing of private keys to protect them through blockchain technology. Through its patent-pending platform, Legacy Suite modernizes the traditional estate planning process with its critical ledger of crypto, NFTs, and all other forms of digital assets in a single secure, personalized, and centralized location.

The Legacy Suite platform makes it simple for users to safeguard important details regarding real estate and financial assets, social media accounts, email accounts, phone and computer passcodes, domain names, utilities, subscriptions, and seller accounts. Legacy Suite is designed for use with a partner or spouse, to protect the family’s assets.

Legacy Suite’s Digital Suite product lets clients manage, create, and share data, digital vaults, and passwords. Users can leverage the suite to store files and individually assign them to digital executors and trusted contacts.

The Legal Suite product can construct digital directives for cryptocurrencies, NFTs, social purposes, healthcare purposes, as well as power of attorney documents. A vault is also included through the Legal Suite line that can be used to safely organize and manage that documentation.

Maintaining those assets in one centralized location makes password sharing and the strategic distribution of critical information simple and efficient. Legacy Suite allows heirs to have full knowledge of an entire digital portfolio, such as what was owned by the original user, where certain assets are located, and how they can access them if the original user dies or becomes incapacitated.

Legacy Suite products leverage blockchain technology to protect those assets. It employs security encryptions cast using 256-bit AES encryption out of 128-bit and 192-bit to create a virtually impenetrable level of security. That secure storage, combined with the ability to reliably control shared access, ensures that assets are never lost or stranded.

The products leverage password manager LegacyPass™️, which has unique capabilities and uses innovative blockchain technology to encrypt and decrypt information using the Hybrid encryption scheme to share passwords and credentials securely with loved ones.

In addition, the Legacy Suite team continues to think and create and plans to add additional features in future generations of the platform, while providing an invaluable service at value pricing.

To learn more about Legacy Suite’s rollout of the new Legal and Digital Suite, please visit https://www.legacysuite.com.

About Legacy Suite

We’re thinkers, no. Artists, yes. We are determined to reframe digital utility, to shape and sculpt your legacy. Day in and day out, our artists like to challenge their mantra and are a group of code casters that don’t know when to quit. Visit https://www.legacysuite.com.

Contact Information:

Buse Kayar

Press Release Service

by

Newswire.com

Original Source:

Legacy Suite Introduces Legal and Digital Suite to Product Portfolio

Learn, Act, and Share to Join the Fight Against Homelessness

Learn, Act, and Share to Join the Fight Against Homelessness

IRVINE, Calif. – November 1, 2022 …

NEW YORK – November 1, 2022 – (Newswire.com)

Now that President Biden’s student loan forgiveness option is available, many people are wondering if it’s worth pursuing it, as working with bureaucracies like the federal government can seem like a headache.

Unfortunately, there are many scams out there trying to take advantage of people who are thinking about this option. Here’s what you need to know and how to prevent yourself from getting scammed.

Why would scammers target student loans?

Unlike other student loan alternatives, education loans are one of the toughest debts to get rid of. They rarely qualify for outright forgiveness and cannot be written off with bankruptcy.

Consequently, many scammers see this as an opportunity to take advantage of desperate people. Now with student loan forgiveness available for a limited time, people looking to rip off well-intentioned but naive debt holders are at a critical level.

Common student loan scams

There are a few scams that you may run into when looking into student loan forgiveness.

The most common is the “loan forgiveness scam.” This is when someone tells you that you can get your entire student loan forgiven quickly, usually within a couple of months. However, this is almost never true. To get your loan forgiven, traditionally, you must go through a process that can take many years and require a lot of paperwork.

President Biden’s student loan forgiveness program removes these barriers for a limited time. Once his forgiveness program is over, getting your student loan debt absolved will go back to the complicated process it once was.

Another common scam is the “secret student loan forgiveness program.” This is where someone will contact you and tell you that they work for a secret program that can immediately forgive your entire student loans.

How can I avoid being scammed?

Here are some tips to help you identify and avoid student loan forgiveness scams:

1. Refer to government websites for the most up-to-date information – Many scammers will offer information that is not officially sanctioned by the government and will direct you to sales pages set up just to take your money. Legitimate organizations like the Department of Education (DOE) will always have the most up-to-date information.

3. Avoid extraordinarily long and complicated contracts – Many scammers will try to get you to sign an agreement that is overly long and difficult to understand. Contracts like this often contain hidden terms that can lead to unexpected financial obligations later.

4. Be suspicious of anyone who offers a free trial, or money-back guarantee – These are common signs that a scammer is trying to take advantage of you.

5. Don’t pay for advice – Many schemes involve paying a consultant or “debt advisor” in order to get started on the forgiveness process. Legitimate credit counseling services are often not-for-profit and can provide impartial advice that’s low-cost or even free. Don’t let anyone pressure you into making any payments before you know anything about the options available to you.

6. Be wary of offers that seem too good to be true – Many schemes promise student loan forgiveness in just a few short months or even weeks, but don’t fall for promises that are too good to be true.

The bottom line

Although student loan forgiveness scams are rare, they are becoming more popular thanks to the federal student loan forgiveness program happening now. Being aware of the warning signs and taking preventative measures can help you avoid being scammed and get the relief you deserve.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Carolina d’Arbelles-Valle

+1 305 849 8443

Press Release Service

by

Newswire.com

Original Source:

Credello: Student Loan Forgiveness Scams Are Rampant. Here’s How to Spot Them

NEW YORK – November 1, 2022 – (Newswire.com)

Many individuals and families trying to take out car loans have noticed that the monthly payments for those loans are rising in 2022’s latter half. This seems true for gas-powered cars, hybrid vehicles, and electric ones as well.

Anyone looking to get a loan to buy a car probably has questions in light of these monthly payment increases. For instance, you might wonder whether you’re better off waiting a while for the rates to become more favorable. Can you pay off a car loan early? This is what other consumers want to know.

The following article will discuss the best strategies to cope with rising car loan payments.

How Do Car Loans Work?

If you want a loan to pay for a new, used, or certified pre-owned vehicle, you usually get one by approaching a bank or credit union and applying for the loan by filling out the necessary paperwork. Some lending entities allow you to do so online rather than in person.

You’ll show proof of income and whatever else the lending entity requires. If you accept the loan terms, they’ll give you a lump sum of money to buy the vehicle. You’ll then pay back that amount over an agreed-upon period, along with interest. That interest is how the lending entity makes money on the deal.

You can also avoid borrowing money from a lending entity if you have enough for a down payment on the vehicle without one. Some car sellers will even let you drive off the lot with no money down. If you don’t pay anything down at the time of purchase, though, you can expect to pay more every month until you’ve fully paid off the vehicle.

Monthly Loan Payment Amounts Are Rising

As we progress into the 21st century, hybrid and electric cars are becoming more desirable than gas-powered ones. That makes sense since they’re better for the planet, and you don’t have to spend as much on gas when you drive one.

However, hybrid and electric vehicle owners are now paying more each month for the car loans they took out. Many of them are paying $1,000 or more per month. Meanwhile, the average price of a brand-new car in 2022’s third quarter was $45,971, according to J.D. Power and LMC Automotive.

What Are Some Possible Solutions?

You might ponder how to combat higher car loan payments this year. If you haven’t bought a new vehicle yet, you can consider waiting a few weeks till dealerships have their end-of-the-year holiday sales. At that time, the price for this year’s models should drop somewhat.

You can avoid buying a car for now in the hopes that these high loan payment rates will drop. That might be a viable option if you can take public transportation or rideshares to get to your job or anywhere else you need to go.

Maybe you already bought a car, and you’re dealing with high monthly loan payments. If so, you can consider paying back the loan quicker by scraping the money together or borrowing the bulk from a friend or relative. If you pay back the remainder of the loan early, though, you might have to come up with an early payment penalty as well. Check the loan’s fine print to see if that’s applicable.

Choose the Best Available Option

Each consumer must decide what to do in the face of rising car loan payments. You can wait for end-of-the-year sales to see if you can get a better deal on the vehicle you want. You might hold off on buying a car if you can use public transportation or rideshares instead.

Paying off the remainder of your car’s loan is only an option if you can come up with that money. Before you do, check to see whether your loan comes with an early payment penalty.

Be aware of rising car loan payments, and figure out the strategy to combat them that makes the most sense for you.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Carolina d’Arbelles-Valle

+1 305 849 8443

Press Release Service

by

Newswire.com

Original Source:

Credello: Loan Payments for Cars Are Rising

NEW YORK – November 1, 2022 – (Newswire.com)

iQuanti: Deciding where to …

A limited number of one- and two-bedroom Assisted Living apartments are available for rent at The Carolina Inn. Residents welcome being a part of the popular Village Green neighborhood, which boasts mature trees, rolli…

A limited number of one- and two-bedroom Assisted Living apartments are available for rent at The Carolina Inn. Residents welcome being a part of the popular Village Green neighborhood, which boasts mature trees, rolli…

NEW YORK – October 31, 2022 – (Newswire.com)

It’s hurricane season once again, and this year, parts of the U.S. were hit especially hard. Hurricanes have an effect on a wide variety of individuals and families. Current and former military members are some of those who this year’s major storms have impacted.

There’s some good news, though: debt relief for veterans affected by hurricanes is available. We will take some time right now to talk about the details of this program. We’ll also discuss how recent hurricanes have harmed veterans and their families.

How Have the Recent Hurricanes Impacted Veterans?

There were two hurricanes this year that had a catastrophic impact on some veterans and their families. Fiona formed the second week of September of this year. It began as a Category 4 over the Atlantic Ocean and caused damage in several countries.

Ian originated in the third week of September and struck Florida as a Category 4. It was the most devastating hurricane to hit the state since 1935.

Many former service members call Florida home, so it’s not surprising that a disproportionate number of those impacted were veterans. Some of them had their primary residences wiped out by Ian. Others had vehicles and various material possessions destroyed. Still, others were physically harmed by the hurricanes and had to pay for lengthy hospital stays.

What is the Debt Relief Program?

The hurricane debt relief program is aimed toward helping veterans who were directly impacted by recent hurricanes Fiona and Ian.

The VA, which is shorthand for the Department of Veteran Affairs, quickly took steps to implement debt relief for veterans that the two hurricanes we’ve mentioned impacted. The VA allows veterans and their families to suspend debt payments if they were affected by either of the two recent hurricanes.

What Debt Payments Can This Program Suspend?

The VA set up a website and phone number that veterans and their families who suffered losses due to this year’s hurricanes can use. These individuals can suspend payments for medical care and pharmacy copayments. They can also defer payment on debts covering essentials like food and shelter.

Simply put, the program is intended to temporarily suspend the need for veterans and their families to pay back the VA for outstanding debts in the face of this pair of natural disasters. Any veterans or their families who wish to see whether they’re eligible can contact the VA using either the phone number or website set up for this purpose.

This Program Can Help Vets Impacted by Hurricanes

The two hurricanes that caused so much havoc over the past few weeks are almost unprecedented. Nothing similar has happened to the state of Florida for nearly the past hundred years. It’s likely that climate change is fueling larger and more unpredictable storm systems, and these types of weather events might become more commonplace as the years pass.

Veterans and their families who were directly impacted by hurricanes this year may have high medical bills. Others might be dealing with the loss of their homes, vehicles, possessions, and so forth.

The VA has made a phone number and website available that veterans and their relatives can use if they need relief from any outstanding debts they owe. It is not a long-term solution. However, it will provide some welcome short-term relief for individuals who served this country through military service, as well as their families.

Any vets who are interested should reach out to the VA. This entity exists to help out veterans in any way that it can. Debt relief is one way to ease economic hardship following a pair of violent weather events that rocked this country.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Carolina d’Arbelles-Valle

+1 305 849 8443

Press Release Service

by

Newswire.com

Original Source:

Credello: How Veterans Are Hurt Financially by Hurricanes

NEW YORK – October 31, 2022 – (Newswire.com)

It’s Halloween. That probably means decorations are up in your neighborhood. Perhaps you’re putting together your costume if you’re hosting a party or attending one.

Maybe you’re also in an area that sees a lot of trick-or-treaters. If so, you’ll want to stock up on plenty of candy to satisfy the ravenous hordes.

You may have noticed, though, that candy prices are higher than ever. It’s no surprise when you look at inflation and how it’s impacting virtually everything you typically buy. Some estimates put candy prices at about 13% higher than they were last year.

Before you start looking into debt consolidation to pay for fun-size Twizzlers and Snickers bars, read this article. We’ve got some tips for how you can shave dollars and cents off of your Halloween candy budget.

1. Buy in Bulk at Costco or Sam’s Club

One thing you might do if you get overrun with trick-or-treaters each year is to hit Costco, Sam’s Club, or any other store where you can buy candy in bulk at discounted prices. Many of these stores stock larger bags of candy weighing several pounds. You can usually find ones that feature M&M’s, Skittles, and other name-brand favorites.

Ideally, you’ll already have a membership to one of these stores. If you don’t, it’s probably not worth buying a membership just so you can save a few dollars on your Halloween candy purchase.

Instead, you might try to think of any friend, neighbor, or relative who has a Costco or Sam’s Club membership. Maybe they’d be willing to let you borrow it so you can make a run and get the supplies you need.

2. Collaborate with Another House

If the prospect of paying inflated prices for bulk Halloween candy is leaving a sour taste in your mouth, you may also think about going in on a candy purchase with a neighbor on your block. If you go this route, you can either invite them over or else you can turn off all the lights at your house and go over to their place.

When you do, you can take turns passing out Halloween candy to the trick-or-treaters from a single location. If only one of your homes is passing out candy rather than both, you can cut your candy spending in half.

3. Compare Prices and Buy Bigger Bags

One final thing you can do is compare prices on larger bags of candy. Look at 250-count, 300-count, or 500-count sizes. Then, divide the price by the number of individual candies in each bag.

If you compare the prices of large bags of candy at bulk discount stores, your local grocery, and online sellers like Amazon or Oriental Trading Company, you should be able to figure out the best deal. Make sure to leave yourself enough time to get the necessary supplies before the holiday. That might mean either a trip to the store or ordering a bulk candy delivery if you can arrange it before Oct. 31.

Determine the Best Move and Get the Candy You Need

Comparing prices on the larger bags of fun-size candies before you make your purchase can potentially save you some money as the holiday approaches. You might find that a Costco or Sam’s Club is your best bet. If so, use your membership or borrow a card from a neighbor, friend, or relative.

If that’s not going to shave enough cash off your Halloween candy budget, think about teaming up with another household rather than both houses handing out candy. That way, you can still recoil in terror from every scary costume, but you’ll save some money that can go toward paying bills and other pressing expenditures.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Carolina d’Arbelles-Valle

+1 305 849 8443

Press Release Service

by

Newswire.com

Original Source:

Credello: Halloween Candy Prices Are Insane This Year: How to Survive It.

The three-day open house will reveal the luxury interior design firm’s holiday decor for the upcoming season.

The three-day open house will reveal the luxury interior design firm’s holiday decor for the upcoming season.

CLARENDON HILLS, Ill. – October 31, 2022 – (Newswire.com)

Linly Designs, a luxury interior design firm based in the greater Chicago area, has officially announced the dates for its annual Christmas Open House. The event kicks off on Thursday, Nov. 3 at 10 a.m, and will run until 8 p.m. The first day of the open house will feature live music, wine, and hors d’oeuvres from 4 p.m. until 8 p.m. The event continues on Friday, Nov. 4, running from 10 a.m. to 5:30 p.m., and concludes on Saturday, Nov. 5, operating from 10 a.m. to 4 p.m.

The Linly Designs Christmas Open House is the ultimate destination for Christmas decorations enthusiasts. a dedicated team of designers who transform an 11,000-square-foot showroom into a head-to-toe winter wonderland overnight, the event is truly the premier holiday event of the year.

The open house features an array of elegantly dressed Christmas trees, each professionally designed with a special theme, as well as custom-designed floral arrangements, sleighs hanging from the ceiling, hundreds of various tree ornaments, and collectible elves & Santas by Mark Roberts. Guests are invited to purchase any of the ribbons, floral stems, and ornaments draped on the display trees. In addition to the breathtaking Christmas decorations, customers may also choose to bring an entire tree design home for the holidays, making for an unforgettable Christmas morning around the tree.

“Our team works tirelessly to build upon past open houses and deliver remarkable shows for our guests,” said Janet Linly, president & CEO of Linly Designs.

“Nothing is ordinary – everything is unique. Our guests love the idea of having pieces that no one else has. Each year, they wait in anticipation for the grand reveal, and we take pride in providing them with the magical experiences they’ve come to expect.”

To learn how to experience the magic of Christmas at Linly Designs’ Christmas Open House, please visit https://www.LinlyDesigns.com for more information.

About Linly Designs

As a leader in the design industry, Linly Designs offers high-end interior design services to create refined living spaces for clients all over the U.S. Operating an 11,000-square-foot showroom in Clarendon Hills, Linly is the only U.S.-based design firm featured in many Royal commemorative publications including their most recent Rolls-Royce Club Platinum Jubilee Edition album. Among their many achievements, Linly Designs is also a member of the Chicago FORBES Community.

Contact Information:

Jennifer Sterna

630.769.5099

Press Release Service

by

Newswire.com

Original Source:

Linly Designs Announces Annual Christmas Open House Dates