New Research Shows Economic, Psychosocial and Data-Management Barriers Inhibit Farmer Participation in Carbon Markets

Producer-focused changes in carbon ecosystem services could unlock vast potential to sequester carbon in the heartland

Producer-focused changes in carbon ecosystem services could unlock vast potential to sequester carbon in the heartland

LENEXA, K…

Producer-focused changes in carbon ecosystem services could unlock vast potential to sequester carbon in the heartland

Producer-focused changes in carbon ecosystem services could unlock vast potential to sequester carbon in the heartland

LENEXA, K…

TentBox, the UK’s leading roof tent manufacturer, helps turn any car into a camper for endless adventure

TentBox, the UK’s leading roof tent manufacturer, helps turn any car into a camper for endless adventure

SOUTHAMPTON, England – October 27, 2022 – (Newswire.com)

After recently making waves across the world, with a viral video that has over 71 million views, and enabling thousands of adventures in Britain, TentBox is now ready to start making adventures happen stateside.

This revolutionary car-to-campervan concept has been a huge hit with wild campers and weekenders in the UK and, with a range of ultra-rugged and roomy roof tents to suit all car sizes, lifestyles and budgets, there’s a model to suit everyone stateside now too. To make the U.S. launch even more exciting, TentBox is offering $100 off the price of a TentBox for the first 100 USA buyers.

TentBox is the #1 British roof tent brand with a range that uniquely turns any car into a camper in seconds. Finally a roof tent not just for trucks! Designed to fit any car from compacts, crossovers and SUVs to MPVs and trucks, even the king of the range, the TentBox Cargo, which has a weight of 163lbs, promises to suit most roof load limits with ease.

The appeal of the TentBox concept lies in its convenience – it’s perfect for campers who just want to pull over and pitch up a cosy, comfortable tent with a high-density memory foam mattress in seconds. Sleeping a maximum of three with a super-fast, gas-assisted opening and room to store bedding on two of the models makes it easy to be up top and camping out in no time.

A TentBox model to suit every car

The entry-level TentBox, the TentBox Lite, is a great all-rounder at 110lbs with room for three people and a fold-out system that takes just five minutes to set up and has a cool skylight for stargazing and sunrise catching. A welcome pack with complimentary fairy lights is a great touch too. All of this is available for just $1,495, including free shipping.

The TentBox Classic weighs in at 143 lbs, sleeps two and opens up in just 60 seconds thanks to the gas-assisted opening. There’s plenty of room to keep bedding inside even when it’s closed up. Pitch up, pop open the Classic, and camp for the night. This one costs $2,995 with free shipping, making it an affordable way to live the van life without a van.

Back to the king of the range, the Cargo is built for hardcore adventure for two with its premium-grade aluminum construction and accessory rails. Taking just 30 seconds to launch, there is plenty of space to store the bedding and ladder inside, rugged ripstop canvas walls and integrated ventilation to encourage airflow and combat condensation. A major plus with the Cargo is its ability to carry bikes, kayaks, surfboards and more, safely and securely on the accessory rails. All of these extra benefits are available for just $3,495.

Co-founder and Product Designer Ollie Shurville explains why TentBox is already shaking things up for adventurers stateside: “We’ve got an incredible following from the TentBox Community in the UK,” he says. “But we realised that there was a huge demand for our products in the USA when an Instagram video that featured our products went viral and we were inundated with requests from Americans who wanted to join the TentBox adventure.

“We researched and explored our options, and we now have two U.S. warehouses, one in California and one in Ohio, fully stocked and ready to ship across the whole of the USA. We offer free delivery anywhere in the USA, and our UK-based product experts are available on the phone or by email to offer advice and answer your questions. It’s a super-exciting time for the TentBox family – and we can’t wait to start welcoming TentBoxers from the USA, who we know are going to fit right in!”

Prices range from $1,495 for the TentBox Lite to $3,495 for the TentBox Cargo – remember the first 100 US buyers will get $100 off their purchase. Every model comes with a ladder, mattress, fixing kit and a five-year guarantee. There’s also a great range of accessories to boost the comfort of any camping trip and to create even more shelter and space when the next adventure calls.

Want to join the TentBox adventure? The loyal TentBox Community and Facebook group following want to share experiences and meet up for road trips and campouts. Check out tentbox.com/us to get the adventure started.

Contact Information:

Matt Trinder

Head of Sales & Marketing Tentbox

+447807548796

Related Files

TentBox, the UK’s 1 roof tent brand, launches in the USA.docx.pdf

Press Release Service

by

Newswire.com

Original Source:

TentBox, the #1 British Roof Tent Brand, Launches in the USA by Popular Demand

Get to know the Kylian Mbappe’s Lifestyle in 2021.We tell you all about Mbappe and his luxurious lifestyle

Get to know the Kylian Mbappe’s Lifestyle in 2021.We tell you all about Mbappe and his luxurious lifestyle

The Association Continues to Elevate its Board Membership with the Addition of High-Level Industry Experts Catherine Remy of LANXESS and Bertrand Lemont of OnScent

The Association Continues to Elevate its Board Membership with the Addition of High-Level Industry Experts Catherine Remy of LANXESS and Bertrand Lemont of OnScent

…

Founder of Craft Box Girls Shares Tips for Creating Memorable Crafts & Memories

Founder of Craft Box Girls Shares Tips for Creating Memorable Crafts & Memories

DIY expert Lynn Lilly Shares Halloween Craft Magic Create, design…

Acquisition of 20,000-square-foot laboratory adds capacity to support increasing demand for environmental testing and analysis services in New Jersey and New York City.

Acquisition of 20,000-square-foot laboratory adds capacity to support increasing demand for environmental testing and analysis services in New Jersey and New York City.

…

With International Internet Day coming up on Oct. 29, the award-winning online language school celebrates the advantages of e-learning.

With International Internet Day coming up on Oct. 29, the award-winning online language school celebrates the advantages of e-learning.

Learn a Lan…

Amazon Offsets Logo Amazon Offsets Logo & Tagline

Amazon Offsets Logo Amazon Offsets Logo & Tagline

MUNCY, Pa. – October 25, 2022 – (Newswire.com)

…

Trevor Noah is a South African comedian, political commentator, and television host. Trevor Noah is the host of

Trevor Noah is a South African comedian, political commentator, and television host. Trevor Noah is the host of

NORMAN, Okla. – October 25, 2022 – (Newswire.com)

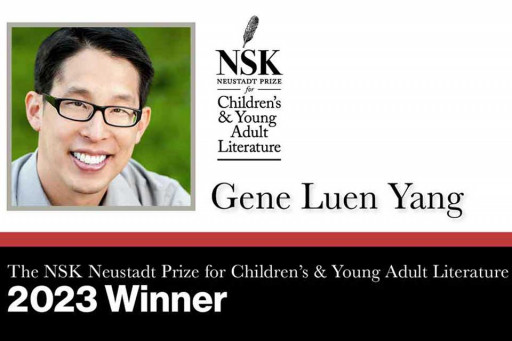

World Literature Today, the University of Oklahoma’s award-winning magazine of international literature and culture, today announced Gene Luen Yang as the winner of the 2023 NSK Neustadt Prize for Children’s and Young Adult Literature. He is the first graphic novelist to win the prestigious prize.

Yang’s American Born Chinese was the first graphic novel to be nominated for a National Book Award and the first to win the American Library Association’s Printz Award.

In 2013, Boxers & Saints, his two-volume graphic novel about the Boxer Rebellion, was nominated for a National Book Award and won the Los Angeles Times Book Prize. In 2016, the Library of Congress, Every Child a Reader and the Children’s Book Council appointed Yang the National Ambassador for Young People’s Literature, and he was a three-time honoree for the 2021 Eisner Awards.

Trung Le Nguyen, an award-winning comics writer and artist, nominated Yang for the NSK Prize and chose his graphic novel American Born Chinese as the representative text for the jury to read.

“American Born Chinese deftly handles issues of immigration [and] internalized racism as if believing in the capacity for very young readers to synthesize disparate and complicated modes of written communication,” Nguyen wrote in his nominating statement.

Kathy Neustadt, representing the Neustadt family, made the announcement during the annual Neustadt Lit Fest. The next lit fest will be given in Yang’s honor in October 2023.

Highly respected within the literary community for its recognition of excellence, the NSK Prize was first given in 2003 to Mildred D. Taylor, author of Roll of Thunder, Hear My Cry. Additional past winners are Brian Doyle (2005), Katherine Paterson (2007), Vera B. Williams (2009), Virginia Euwer Wolff (2011), Naomi Shihab Nye (2013), Meshack Asare (2015), Marilyn Nelson (2017), Margarita Engle (2019) and Cynthia Leitich Smith (2021).

A blue-ribbon jury selects the finalists and the winner based solely on literary merit as well as the importance of the writer’s contribution to children’s and young adult literature. NSK winners are awarded $35,000, a silver medallion, and a certificate of recognition.

Contact Information:

Terri Stubblefield

Director of Marketing

4053254531

Press Release Service

by

Newswire.com

Original Source:

Gene Luen Yang Named Winner of 2023 NSK Neustadt Prize for Children’s and Young Adult Literature